What is Stamp Duty and What Does it Pay For?

Stamp Duty Land Tax is paid to the Government in return for a Certificate of Land Ownership that is issued by the HM Revenue & Customs. This states that the land on which your new property sits is legally owned by you. If you are liable to pay stamp duty, then this is something that needs to be factored in when purchasing your property.When Does Stamp Duty Need to be Paid, and How Do I Pay it?

If you are eligible to pay stamp duty, then this must be paid within 30 days from the date of completion on your home. Usually, your solicitor will arrange the payment for you, but it is your legal responsibility to ensure that stamp duty is paid.If your stamp duty is not paid within 30 days of completion, you may be fined and charged interest on the outstanding cost so it is within your best interest to pay promptly.

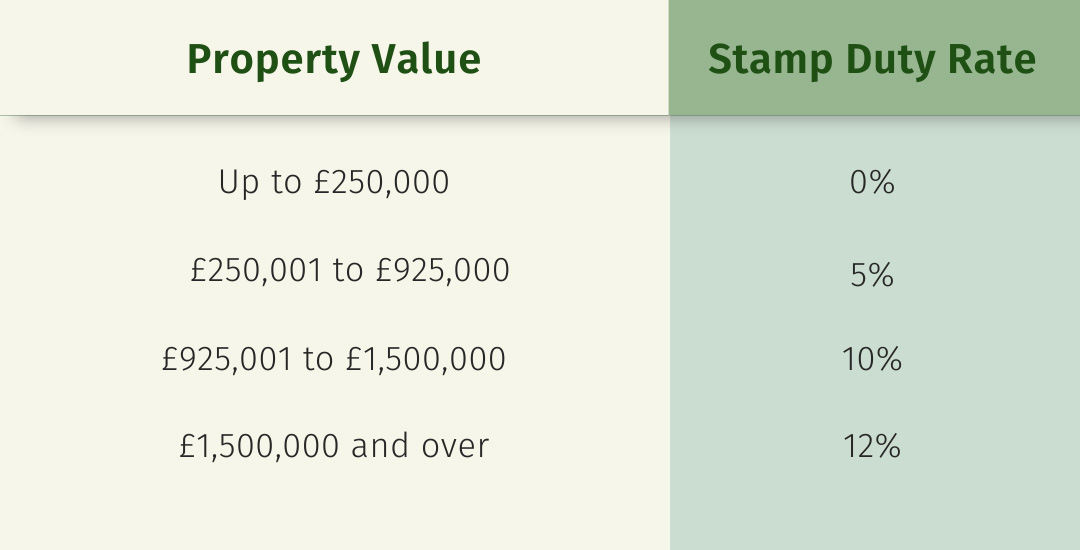

How Much Stamp Duty Will I Pay?

In England and Northern Ireland, no stamp duty is payable on the first £250,000 of the property price. After that, the rate applies to that portion of the property price above £250,000. If you are a first-time buyer, you will not pay any stamp duty on the first £425,000 of the purchase price. Keep reading to find out how much stamp duty you will be required to pay.The following rates apply if this will be the only residential property that you own and you are not a first-time buyer.

Check out this stamp duty calculator if you are unsure of the exact amount of stamp duty that you will have to pay.

How Much Stamp Duty Does a First-Time Buyer Pay?

If you are a first-time buyer, you may be able to claim relief on stamp duty. However, all parties must be first time buyers to be eligible for the discount. The following applies:- No stamp duty payable on properties up to £425,000.

- 5% stamp duty payable on properties on the portion from £425,001 to £625,000.

- No discount or relief on properties £625,001 or over.

.jpg)